Tax Returns

Tax Returns in Cloud Accounting

For those companies/sole traders resident in Europe, the VAT return is an essential part of the financial calendar which must, in general, be returned by a specific date on a bi-monthly basis if heavy penalties and interest are to be avoided.

In other countries similar rules apply but the returns may have slightly different time frames or return rules.

In a number of accounting packages the VAT return is simply produced by the system, without any intervention, based on a number of pre-defined rules based on transactions dates, whether or not the company makes its returns on a ‘cash’ or invoice’ basis, etc.

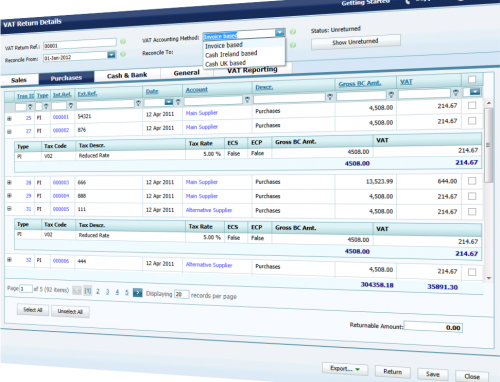

However, DynamicsIQ provides a fully interactive VAT return function which allows you a much larger degree of flexibility while still maintaining the integrity of the return itself.

The application also lets you ‘save’ the VAT Return at any stage without actually completing it. This allows you to re-open it at any stage and make amendments without losing any of your previous work. This is especially useful if you are dealing with a large number of taxable transactions in any one return.

Other Features:

- You can select transactions for inclusion on a return and view full details of the transaction from the screen

- Handles EC purchases and sales tax reports

- Facilitates reporting of tax on cash and bank transactions, together with any tax posted through the GL

- Handles Cash Based (Receipts and/or Payments) and Accruals (Invoice Based) Returns for the UK and Ireland

- You can choose which accounting method (cash or accruals) when completing each return

- Produces VAT100 and VAT3 reports for UK and Irish Returns

- Produces a detailed Audit Trail of taxable transactions for your records

- Auto generates VAT return journals which flush the sales and purchases VAT accounts and post to the overall VAT Liability account

- INTRASTAT reporting available

Other Jurisdictions – US & Australian Tax

The application has worked with many partners and client companies in the US and Australia to handle US Sales Tax and Australian GST and other tax rates including consolidated tax rates.

Reports are also available upon which you can base your Australian BAS Returns.

FOLLOW US