Banking

Banking

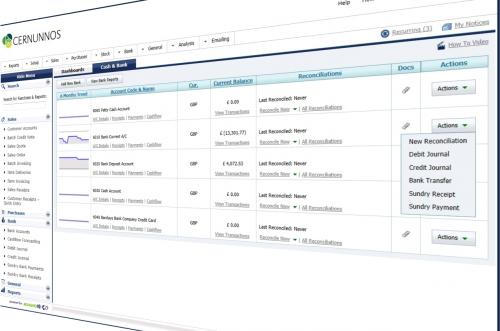

Instant Picture of Your Bank Accounts

The application provides a central screen where your banks are listed in an easy to read table grid and a set of functions are available per bank.

It has been designed to ensure that you can quickly and easily carry out most of the day to day tasks related to your bank accounts from this screen including processing bank payments and receipts, creating bank reconciliations, and viewing and editing bank transactions.

Save Time with Batch Entry

We understand that entering bank transactions quickly and accurately is of paramount importance in an accounting system.

That’s why we’ve built Bank Payments and Receipts functions that:

Supports high volume batch transactions entry

Auto-saves your entries as you go along. This allows you to close and return to them at any point before processing

Record payments and receipts against foreign currency banks and credit cards. Apply an exchange rate to the transaction

Include tax on a bank receipt or payment

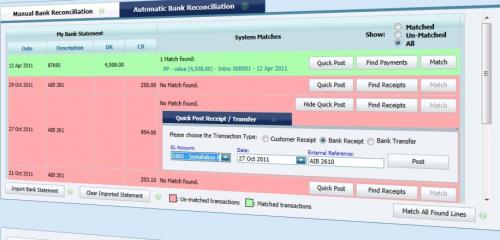

Reconcile your Bank Accounts in Minutes with Auto Bank Reconciliation

Auto Bank Reconciliation enables you to upload an electronic version of a bank statement (provided by the bank) and automatically reconcile it to your system bank using matching rules applied by the system.

Where the system cannot match transactions, it will suggest several possible matches or allow you to create and post a matching transaction.

This is a great way of reducing the manual effort in reconciling your system bank accounts with your bank statements and improving accuracy.

You can quickly identify unreconciled items and complete reconciliations when you need to – daily, weekly or monthly.

Revalue your Foreign Currency Bank Accounts in Seconds

You can revalue the balances of your foreign bank using the month end exchange rates.

Adjusting journals for the value of the revaluation will be posted to the relevant control accounts and the unrealised gains/losses account.

It’s good accounting practice to recognise gains/losses as they arise rather than waiting until the transaction is paid and recognise the total realised gain/loss in that period.

FOLLOW US