Group Data Consolidation

Dramatically Reduce Time Preparing Monthly Consolidations

The application’s Group Consolidation makes time consuming and complicated monthly consolidations fast and easy.

Real-time access to consolidated results across the group and related subsidiaries from one single system.

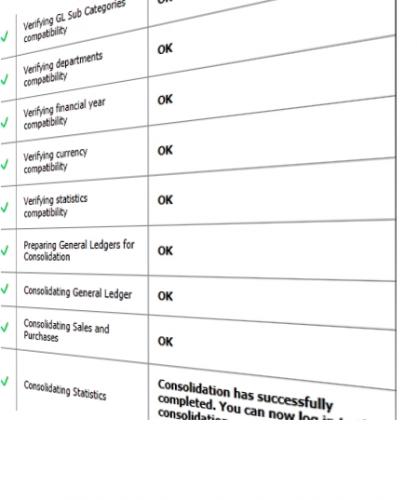

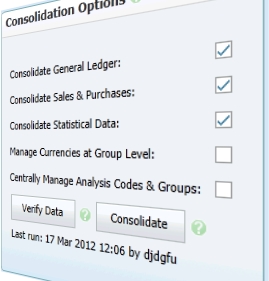

Once set up, the process is simple and takes less than a minute to consolidate multiple subsidiaries with one click. This helps eliminate costly and error prone work flow practices resulting from trying to consolidate data from different systems and spreadsheets.

Consolidate your data when ready and as many times as required to obtain the latest results across the group.

Data integrity is ensured by a thorough set of checks during the consolidation process which is a significant problem with spreadsheet based consolidations. This helps detect any GL coding inconsistencies that could hamper proper summarisation.

Instant Access to Group and Subsidiary Results

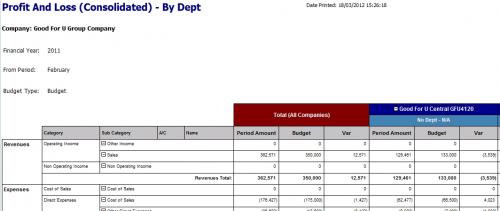

Improve decision making by obtaining real-time visibility of holding companies and subsidiaries’ performance with both standard General Ledger reports (Group Trial Balance, Profit & Loss (Income Statement) and Balance Sheet) as well as Sales and Purchases Analysis.

View overall summaries across the group or drill down to individual subsidiaries.

Group Cashflow reporting summarises cashflows in and out by subsidiary and across the group as a whole.

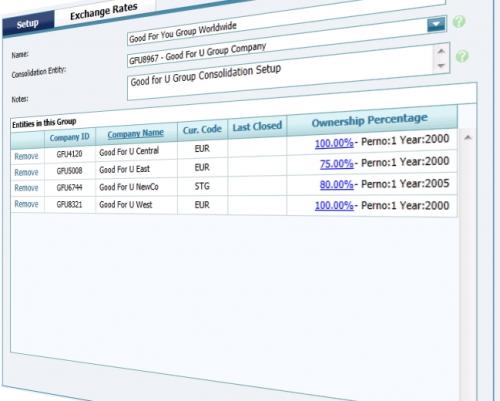

Manage Consolidation of Multiple Subsidiaries (Including Sub Groups)

Engineered to manage the consolidation of a large number of subsidiaries’ datasets with ease.

Also handles sub groups where the consolidated entity itself becomes a subsidiary of a large group consolidation. Ideal for complex corporate structures.

Manage Complex Ownership Arrangements

Consolidation Reporting can automatically recognise Minority Interests liability if the ownership interest is greater than 50% but less than 100%.

Handle Foreign Currency Consolidations with ease

Subsidiaries can operate in their own base currency and results are translated into the base currency of the consolidation entity based on user defined exchange rates for each reporting period.

P&L accounts are correctly translated using average period rates and Balance Sheet accounts at period end rates.

Centrally Control Exchange Rates

No need to waste time maintaining average and period end exchange rates in multiple subsidiaries.

Central Currency Management enables you to maintain rates in one central table. The updates automatically propagate to all related subsidiaries providing greater control over the rates that are set.

Currency Management logic also manages triangulated recalculation of rates for subsidiaries operating in different base currencies.

Report on Budgets & Variances At Group Level

Budgets/revised, actuals and variances are rolled up from subsidiary companies making it easier to view overall performance and trends across the group at any time.

Use Non-financial Statistics to deliver true Business Intelligence

Use non-financial statistics to build industry-specific KPIs such as revenue per customer for hotels, or sales per square foot for retail businesses to better measure your business performance over time.

Simplify the posting of Intercompany Charges

Avoid needless rekeying by raising intercompany Sales Invoices that are saved as Purchase Invoices in the receiving company.

Purchase invoices remain “unposted” until properly approved in the receiving company.

Ensures that intercompany accounts remain balanced for elimination at group level.

Manage the Complexities of Month End Currency Revaluations

Provide your team with the tools to simplify the revaluation of foreign currency bank, debtor and creditor accounts at subsidiary level based on centrally maintained exchange rates.

Unrealised gains (losses) are automatically posted and the base currency values of assets and liabilities can be adjusted prior to consolidation.

This facilitates correct elimination of intercompany balances held in each subsidiary in different base currencies.

FOLLOW US