eBanking Integration

eBanking Integration Overview

Electronic Banking is now well established with almost all banks offering customers access via the Internet in one form or another.

Indeed banks have been encouraging its adoption to move people off labour intensive processes by charging significantly lower fees for electronic transactions.

Yet many SME’s have been slow to adopt it fully, making individual payments or collected bank Statements online, but few have fully automated the process to take full advantage.

Embracing the eBanking Revolution

DynamicsIQ has embraced what eBanking has to offer by integrating with the standard offerings of many banks. The main eBanking functions facilitated by DynamicsIQ are:

Suggested payment process as well as Cashflow forecasting to plan payments easily

Generating electronic payment files to automate supplier payment processing

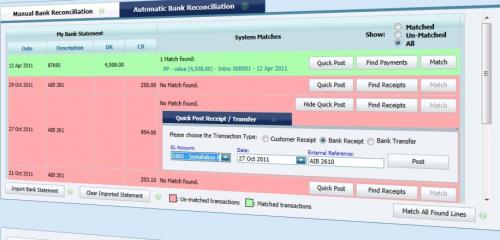

Importing electronic Bank Statements and Auto reconciling them

There are substantial savings for an SME in both actual transaction costs and productivity gains from moving to process all payments electronically.

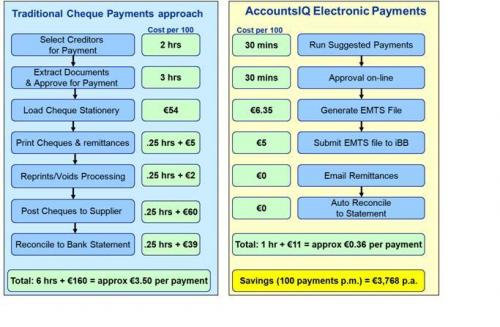

As an illustration for an SME making 100 payments per month:

Cheque Payments – The cost via traditional means includes stamp duty, bank charges, cheque printing, envelopes, postal charges etc totalling €170 or €1.70 per payment. When the labour cost of selecting and deciding what suppliers to pay, authorisation, enveloping/posting, manually reconciling to Bank statements etc (estimated at 6 hours) is added this conservatively increases to about €350 or €3.50 per payment.

Electronic Payment – involves considerably less processing and cost. The application suggests what is due for payment, which can be modified and authorised online (including viewing original invoices online), an electronic payments file is generated and uploaded to your Bank via the Internet, remittances are emailed and statement auto reconciled via DynamicsIQ. 100 payment can be processed at a cost of about €6, adding the labour cost (estimated at 1 hour) the cost would be about €35 or 35 cents per payment – roughly 10% of the cost of a cheque.

Savings Just Waiting to be Made With eBanking

An SME making approximately 100 payments per month would save around €4,000 per annum by moving to electronic payments alone!

The application has fully integrated these processes for many banks, particularly those that follow EMTS, BACS, ABA or AFI standards. However we are happy to integrate to any bank’s eBanking solution which is in a different format – so if your bank isn’t covered just ask!

FOLLOW US