Cashflow Management

Cash is King

You don’t need us to tell you that careful management of cashflow is fundamental to managing a business, especially in these difficult economic times.

Good cashflow management is of key importance when raising investment, obtaining working capital finance, looking for overdraft facilities and in determining the business’ ability to invest further in assets. Poor cashflow management is one of the core reason businesses get into difficulty and eventually fail.

Many businesses maintain an ongoing, monthly cashflow forecast for the current year, and even an annual forecast for the next 3-5 years based on an overall plan or budget for the business. However, more accurate forecasts should be possible on a weekly basis for the next month or two as most of the transactions that will result in cashflow are already known at that stage.

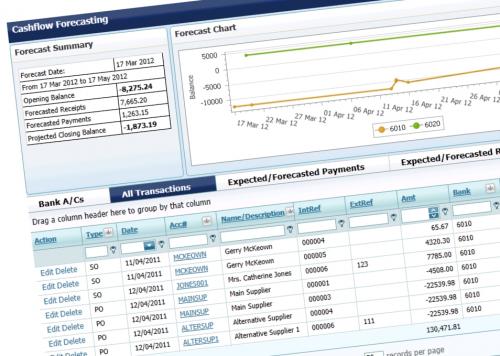

Assess Your Cashflow Position Instantly

To accurately assess the cash position and requirements for the next few months your business must have up to date information on what monies are due to be received by the business and when and what needs to be paid out by the business and when.

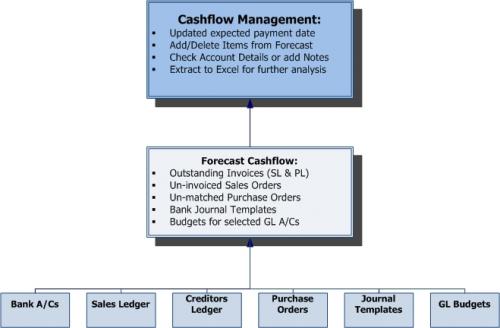

The Cashflow Management module is designed to give you access to that information from the best source available – your accounts.

It provides a tool with which you can manage the expected payment or receipt dates for outstanding amounts.

Predicting the Future Cash Position

The system enables more accurate prediction of your short-term cashflow, based on existing transactions held in the system, historic payment patterns and credit terms actually taken for each customer or supplier.

The Cashflow forecast is prepared from the following:

- Balances in selected or all bank accounts

- Less all expected and forecasted payments for Supplier invoices, Purchase Orders, Purchases, Overheads and Capital Expenditure held in template journals specifically affecting Bank accounts (e.g. Payroll journal templates) and Budgeted Purchases, Overheads and Capital expenditure held against any GL accounts budgets

- Plus all expected and forecasted receipts from outstanding Debtor invoices, Sales orders and quotes, journal templates affecting Bank accounts (e.g. maintenance contract income), Other budgeted receipts from GL accounts e.g. proceeds from the sale of assets of the business or cash sales)

All these elements are extracted and brought into a cashflow model to arrive at a net balance position for each Bank account for the selected date range.

The cashflow for each account is shown on a graph for the period specified.

You can manage this forecast by manipulating the above details to remove/add items and amend the projected payment or receipt date for any of the items listed.

This means the business is on top of the cashflow implications of the business it has done rather than pulling together spreadsheets to try and predict the situation from estimated figures, giving an accurate forecast of cashflow on a day-to-day basis.

FOLLOW US